Write about your approach to budgeting.

Even for an accountant, personal budgeting can be hard. Businesses have different agendas and projects to account and provide funds for and different revenue streams to apply marketing to bring in more income into the organisation. With an individual, you either have salary, wages, or personal business income. If you are full time, you can attempt to gain promotions or pay rises, but if you are a sole trader, your income is directly tied to your skills, trade certificates, market rates, and marketing efforts. Like a big business but harder because you have to do it all yourself or lose some of your income to pay others to help you.

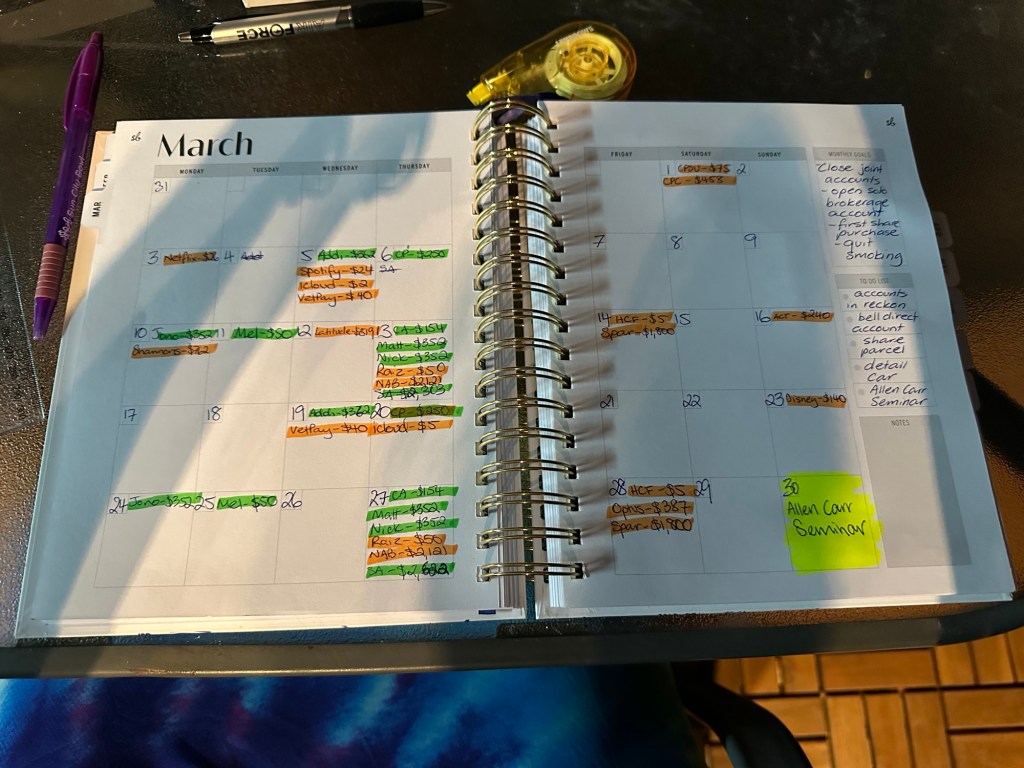

My personal approach to budgeting is a bit more involved than some others may do. I have my transactions on accounting software, and I have a budget planner I am using to map out my upcoming expenditure for the month in. I also have barefoot dates (coined by Scott Pape, the Barefoot Investor) where I look into how I’m going with my personal expenses, my budget v actual amounts, and any financial goals I wish to bring into the coming months/years.

My budget planner is from She Budgets:

https://shebudgets.com.au/home

I know I need to make some changes in my life. Smoking is not a good thing for my health or my budget. I also need to direct any left over money from quitting on the 30th of March to my debts. I want to snowball my debts so any excess will go into my car loan first, then when that is paid off, I will direct the excess and what I was paying on my car loan into my mortgage.

I was living on a two partner income for a long time, but with my husband’s death, that has all changed. I am now living on a solo income and I need to leverage myself for promotional opportunities to bring more money into my budget. I also have a side hustle of an event management business which was on hold throughout Steve’s cancer journey. I really need to take back the full time hours I could not do when caring for Steve and get work fit again. Then I can return to my side hustle on weekends for a little extra income.

I lodge all my transactions in accounting software to enable running reports and checking against prior spending habits to see where I’ve improved and where there is room for improvement.

From this budget, I know I have to cut a lot of costs because the month is almost $2,000 in the negative. The challenge is to break even this month or have some left over. I will rise to the challenge and I will see if another prompt comes up at the end of March or at the start of April to check in with my outcomes and progress.

For now, I will leave you with this quote:

“A budget is telling your money where to go instead of wondering where it went.”

Dave Ramsey

Until tomorrow, KT18Ø.